Data exposes a $1,678 difference between the least to the most-costly premiums province-wide

TORONTO, Jan. 6, 2021 /CNW/ – If you live in Brampton, Mississauga, Vaughn, Richmond Hill or Markham, you paid more for auto insurance than your fellow drivers from other parts of the province, according to RATESDOTCA.

In December 2020, the most expensive cities for car insurance in Ontario were:

According to RATESDOTCA’s data, the average Ontario auto insurance premium in December 2020 is estimated at $1,616, a 9.7 per cent increase from December 2018.

Cities including Toronto ($2,201), Ajax ($2,141), Pickering ($1,961), Whitby ($1,777), Hamilton ($1,755) and Oshawa ($1,636) are above the provincial average.

The difference between the most and least expensive rates in the province was $1,678 per year.

At $1,103, Kingston, Brockville, Napanee and 10 other cities are among the municipalities with the cheapest premiums.

Ontario drivers can discover the average cost of auto insurance in their postal code by visiting Insuramap, a unique interactive online map offered by RATESDOTCA.

“Despite insurance companies offering $1 billion in premium relief to Ontario drivers to soften the impact of the COVID-19 pandemic in 2020, the cost of car insurance in the GTA remains the highest in the province,” says Liam Lahey, editor, RATESDOTCA. “The premiums GTA drivers pay can be attributed to many factors such as the number distracted driving fines and car accidents in the region, as well as the escalating costs to repair technologically advanced vehicles.”

Toronto car insurance rates are “all over the map”

As the sixth most expensive city in Ontario, the average Toronto auto insurance premium was $2,201 in December 2020, up by 12.9 per cent from $1,948 in December 2018. However, drivers who live in the northern areas of the city may have paid more for coverage with premiums in these parts of Toronto ranging from $2,202 to $3,000 per year.

The priciest wards in Toronto for car insurance in December 2020 were:

|

Ward |

Postal Code Starting With |

Borough |

Estimated Premium |

|

Scarborough-Rouge Park, |

M1B, M1J, M1X |

Scarborough |

$3,000 |

|

Humber River-Black Creek |

M3J, M3N, M9L, M9M |

North York |

$2,864 |

|

Etobicoke North |

M9V |

Etobicoke |

$2,864 |

|

York Centre |

M3H |

North York |

$2,593 |

|

Scarborough Southwest, |

M1K, M1S, M1T, M1V |

Scarborough |

$2,529 |

|

Scarborough-Guildwood, |

M1G, M1H, M1P |

Scarborough |

$2,491 |

|

Humber River-Black Creek, |

M3L, M3M, M6M |

North York |

$2,463 |

|

York-South Weston, |

M6N |

Toronto |

$2,463 |

|

York-South Weston |

M9N |

North York |

$2,463 |

|

Etobicoke North |

M9W |

Etobicoke |

$2,463 |

Toronto by the numbers:

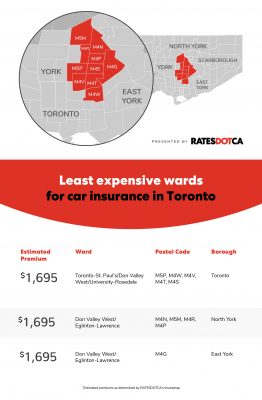

- The cheapest rates in Toronto in 2020 are estimated to be $1,695 in the North York ward of Don Valley West, this is up from $1,533 in 2018.

- The difference between the highest and lowest rates in Toronto was $1,305.

-

Least expensive wards for car insurance in Toronto (CNW Group/RATESDOTCA)

“Car insurance rates vary considerably from one municipality to another and between different insurance companies,” Lahey adds. “The only way to know if the premium you’re paying is the best and right one for the type of coverage you need, is to shop around by comparing policies and quotes online. By taking a few minutes to compare rates and using Insuramap, you may be able to discover a lower premium.”

About Insuramap

Introduced in 2016, RATESDOTCA’s Insuramap is an interactive online map, which lets Ontario drivers see how car insurance rates compare to other parts of their city or province. All estimated premiums are based on a 35-year-old driver of a 2017 Honda Civic DX 4DR with a clean driving record.

About RATESDOTCA

RATESDOTCA is Canada’s leading rate comparison website that offers a quick and simple digital experience to compare the widest selection of insurance and money products in the market. Get a better rate on car, home, and travel insurance, mortgage, and credit cards all in one location. RATESDOTCA aims to help Canadians make better insur