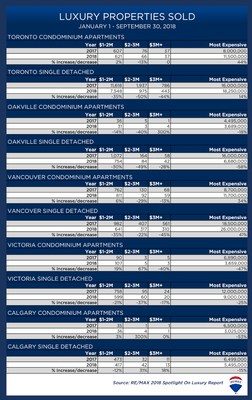

TORONTO and KELOWNA, BC, Oct. 23, 2018 /CNW/ – Sales of single-detached homes priced $1-2 million have declined in Toronto and Vancouver, down 35 per cent year-over-year, according to the 2018 RE/MAX Spotlight on Luxury Report. In contrast, condominiums in the $1-2 million range remain popular, particularly in larger urban centres. Toronto experienced a two per cent increase in luxury condo sales, while Vancouver sales were up six per cent and Victoria luxury condo sales increased 19 per cent. These trends have been largely driven by Baby Boomers and Millennials.

“Many Canadian Baby Boomers saw the strength of the real estate market over the past two years as an opportunity to cash-in, downsize and upgrade into the luxury market for retirement,” says Christopher Alexander, Executive Vice President and Regional Director, RE/MAX INTEGRA Ontario-Atlantic Canada Region. “We’re also seeing an emerging trend of Millennials entering the lower end of the luxury condo market, as they tap into their inheritance to invest in this popular property segment.”

While luxury condo sales soar, single-detached activity in Toronto and Vancouver continues to be impacted by the foreign buyer’s tax. Year-over-year single-detached sales in the $1-3 million range were down 37 per cent in Toronto and 31 per cent in Vancouver.

“The foreign buyers tax has impacted overseas activity, opening more opportunities for local buyers to enter the luxury market,” says Elton Ash, Executive Vice President, RE/MAX of Western Canada. “As a result, local buyers are driving demand for luxury condos going into 2019, which is welcome news for developers in major city centres looking to build more properties.”

Canada’s condo hot spots of Toronto and Vancouver saw year-over-year increases in most expensive condo units on the market. In Toronto, the priciest condo sold for $11.5 million in 2018, up from $8 million in 2017 (+44 per cent). Meanwhile in Vancouver, the most expensive condo sold for $11.7 million, up from $8.7 million in 2017 (+34 per cent). In comparison, year-over-year declines in highest selling price of a condo were seen in Calgary (-53 per cent), Victoria (-47 per cent) and Oakville (-18 per cent).

Other Key Findings:

- In Vancouver, single-detached homes and condos in the $3+ million range decreased year-over year by 45 per cent year and 13 per cent.

- In Toronto, single-detached homes in the $3+ million range decreased year-over-year by 44 per cent, while condo sales remain unchanged.

- In Oakville, both luxury home and condo sales in the $1-2 million price range decreased by 30 per cent and 14 per cent, respectively, thanks in part to lower inventory levels.

- In Victoria, condos in the $1-2 million range experienced a 19 per cent increase year-over-year and condos in the $2-3 million range experienced a 67 per cent increase year-over-year. However, condos priced $3 million+ experienced a decline of 40 per cent.

2018 RE/MAX Spotlight on Luxury Report

The 2018 RE/MAX Spotlight on Luxury Report includes data from local boards and brokerages. Brokers and agents are surveyed on trends, local development and features. Please note, “condos” refers to “apartment condos” and does not include townhomes. It should be noted that the threshold for ‘luxury’ homes can vary by market, with higher prices typically seen in Vancouver and Toronto.

About the RE/MAX Network

RE/MAX was founded in 1973 by Dave and Gail Liniger, with an innovative, entrepreneurial culture affording its agents and franchisees the flexibility to operate their businesses with great independence. Over 120,000 agents provide RE/MAX a global reach of more than 100 countries and territories. RE/MAX is Canada’s leading real estate organization with more than 20,000 Sales Associates and over 900 independently-owned and operated offices nationwide. RE/MAX, LLC, one of the world’s leading franchisors of real estate brokerage services, is a subsidiary of RE/MAX Holdings, Inc. (NYSE: RMAX). With a passion for the communities in which its agents live and work, RE/MAX is proud to have raised millions of dollars for Children’s Miracle Network Hospitals® and other charities. For more information about RE/MAX, to search home listings or find an agent in your community, please visit www.remax.ca.

Forward-Looking Statements

This press release/report includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate,” “believe,” “intend,” “expect,” “estimate,” “plan,” “outlook,” “project” and other similar words and expressions that predict or indicate future events or trends that are not statements of historical matters. These forward-looking statements include statements regarding the future of commercial and residential real estate markets and statements regarding the Company’s performance, outlook, and strategic and operational plans. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward looking statements are based on information available at the time those statements are made and/or management’s good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Such risks and uncertainties include, without limitation, (1) changes in business and economic activity in general, (2) changes in the real estate market, including changes due to interest rates and availability of financing, (3) the Company’s ability to attract and retain quality franchisees, (4) the Company’s franchisees’ ability to recruit and retain agents, (5) changes in laws and regulations that may affect the Company’s business or the real estate market, (6) failure to maintain, protect and enhance the RE/MAX brand (7) fluctuations in foreign currency exchange rates, as well as those risks and uncertainties described in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” in the most recent Form 10-K filed with the Securities and Exchange Commission (“SEC”) and similar disclosures in subsequent reports filed with the SEC, which are available on the investor relations page of the Company’s website at www.remax.com and on the SEC website at www.sec.gov. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Except as required by law, the Company does not intend, and undertakes no duty, to update this information to reflect future events or circumstances.