Canadians with an advisor report feeling significantly better

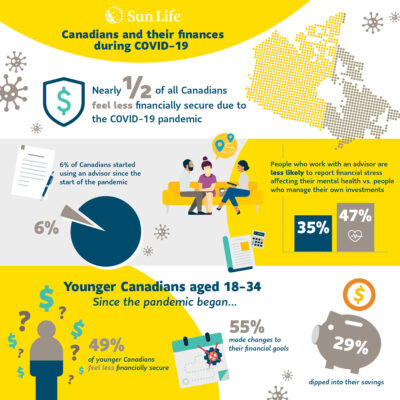

TORONTO, Sept. 8, 2020 /CNW/ – A recent Sun Life survey indicates that nearly half of all Canadians (45%) feel less financially secure since COVID-19 began. The survey also highlights the interconnectedness of health and finances. 44 per cent of those who say their mental health has been affected by the pandemic identify financial stress as the main factor.

According to the survey, Canadians working with an advisor are feeling more financially secure and are experiencing less mental health impacts than those who are managing their finances and investments on their own. Among those who said their mental health has been negatively affected by the pandemic, those who use an advisor (35%) are less likely to report financial health concerns as a major factor weighing down their mental health. That figure rises to 47 per cent among those who manage their investments themselves.

Despite identifying financial concerns, only six per cent of Canadians surveyed began using an advisor since the pandemic began.

“With a large percentage of Canadians feeling less financially secure as a result of the pandemic, there is no better time to seek advice from a trusted advisor – one who knows you and your personal goals,” said Rowena Chan, President, Sun Life Financial Distributors (Canada) Inc. and SVP, Distribution. “It’s important for Canadians to have health, wealth and protection solutions in place. At Sun Life, we are in the unique position to help ensure you have a holistic, sustainable plan to address your needs and goals – no matter your life stage.”

Younger Canadians (18-34 years old) feel least financially secure across all demographics

Across the population, younger Canadians appear to be feeling the impact of the pandemic the greatest with 49 per cent feeling less financially secure. In fact, over half of young Canadians surveyed (55%) report having made changes to their financial goals and plans due to the pandemic with 29 per cent saying they have had to dip into their savings during COVID-19.

Planning for the future is key to achieving lifetime financial security and living a healthier life. Working with an advisor can help build a deeper understanding of where money will come from, how to adapt finances to the different moments of life, how to work with a solid plan to maximize retirement savings, and how to protect against unexpected circumstances.

“Everyone can benefit from holistic and personalized financial advice,” explains Ms. Chan. “Working with an advisor can help build a new level of confidence and a lifetime of financial security and well-being. Sustainable investing, increasing financial security and fostering healthier lives are part of our approach to sustainability at Sun Life. We are committed to empowering Clients, colleagues, Employees and communities to build a more resilient Canada.”

About the survey

The survey is based on findings of an Ipsos poll conducted between July 24 and July 27, 2020. A sample of 1,001 Canadians was drawn from the Ipsos I-Say online panel aged 18 and older. The data for Canadians surveyed was weighted to ensure the sample’s regional, age, and gender composition reflects that of the actual Canadian population. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within +/- 3.5% at 95% confidence level had all Canadian adults been polled. All sample surveys and polls may be subject to other sources of error, including, but not limited to methodological change, coverage error and measurement error.