From a very young age, Farooq wanted to help people through volunteering and doing charity. As he grew up, he started to understand that he was very good at managing money. Understanding people and equity markets were his passion. In university, everyone would come to him and help them with their bursary applications, OSAP forms, tax forms, and anything related to money. So getting into wealth management was a natural calling. It allowed him to help people in one area where he is gifted and passionate.

Farooq has worked in wealth management for the past fifteen years and with RBC Dominion Securities for the last two-and-a-half years.

Your approach towards investment?

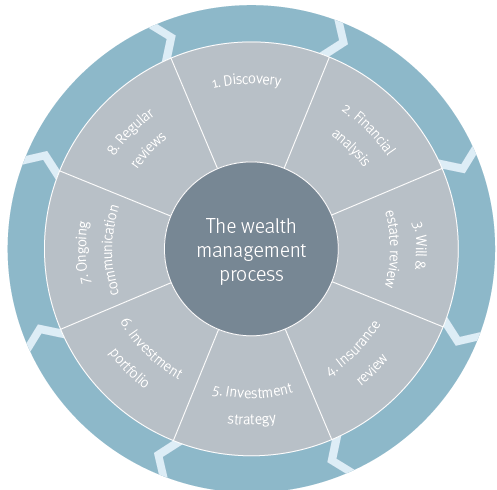

I provide a customized solution through the wealth management approach. First, I conduct a discovery where I understand the client’s goals, needs, and aspirations. Then I prepare a customized analysis of their financial situation that incorporates their financial goals, risk tolerance, and long-range plans. Then depending on the client, we would conduct a will and estate review, insurance review, and devise the investment strategy based on the risk tolerance and goals. I then implement their customized portfolio. I ensure I conduct regular and ongoing communication with my clients and at least an annual review.

What kind of clients do you work with?

I only work with clients who are willing to go through the planning process. My clients include those saving for retirement and will use most of their savings before death to self-employed with significant value in the business.

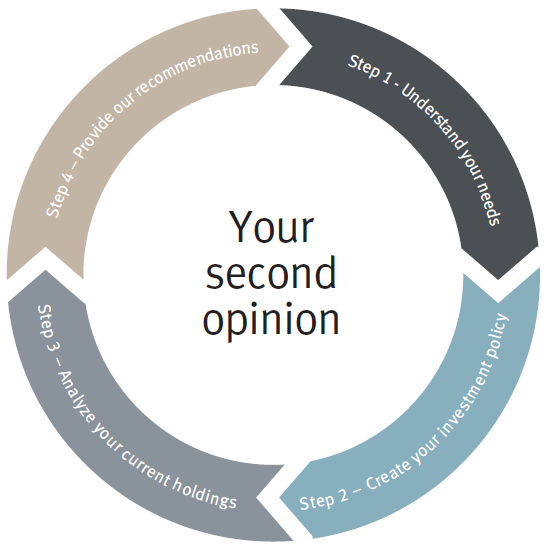

Each has unique requirements, but the first step is the discovery meeting and initial financial plan. I primarily deal with clients who have complex financial planning needs where I would need to involve our high-net-worth planning specialists and will and estate consultants to help with tax planning and creating efficiencies. What sets me apart is that I genuinely care about my clients, and I have the unique ability to understand and get to the root of their issues, break down complex problems into simple situations and help them with innovative solutions.

What investment benchmark do you use?

The benchmark has to be the client’s financial plan. What are the values compared to what they should have been? Are we on track to achieving the goals we set out to achieve?

It is not as important whether the client made 5 percent, 10 percent, or 20 percent because each client will have their risk tolerance, but it is more critical to meet their goals based on their financial plan.

How do you gain the trust of your clients?

I work with clients on a goals-based approach. When you spend time listening to them, understanding where they are at, where they want to be, and introduce them to tangible ideas and solutions that will get them to their goals, that builds trust. When required, I introduce my team of wealth management specialists of lawyers, accountants, high-net-worth planners, certified financial planners for will and estate reviews, high-net-worth planning and tax solutions, financial planning, and estate planning, who all provide independent advice for the client’s benefit.

Your long-term vision for this business? How do you see yourself five years down the lane?

In the long-term, there must be an even greater emphasis on a collaborative approach to wealth management. As an advisor, I have complete information on my client’s plans, thoughts, dreams, and goals. They rely on me to anticipate and involve specialists and partners from other businesses to help them achieve those dreams and goals. My goal is to be the most trusted advisor for my clients and their network. When anyone I know or they know has a banking-related question or problem, the first person they should think of should be Shahan. I see my business growing, adding more associates in my team, and seeing my clients and their families achieving their goals, hopes, and dreams.

Any message for your audience who are on their way to an innovative startup?

The first rule is to care about the people you are meeting as prospective clients, their stories, and their dreams. You have to listen to the client, their needs, their goals, their aspirations, and they should be as crucial for you to get them there as it is to them, maybe even more critical. It is not about the highest returns, having the best stock tip, or even the most designations. It is about keeping the client on course to achieve their goals in the most tax-efficient manner possible and to take the emotion out of investing.

In this kind of business, dissatisfaction can only happen when the wealth management process is not followed. This is why it is critical to take clients through the entire business process and complete regular reviews.

For further details, please visit:

https://ca.rbcwealthmanagement.com/web/shahan.farooq/

Author: Sarah Syed, Content Writer, Toronto, Canada. If you have more stories to share, kindly email:- saraimransyed@hotmail.com